Hi Everybody, welcome to the Blog of the Week!

This one is more informative than interesting… but nonetheless a must know for anyone buying a home with less than 20% to put down!

Lets try to keep this as simple as possible.

CMHC insurance, or mortgage default insurance, is an additional premium added to a mortgage amount to protect lenders from losses, for buyers that have less than 20% of the purchase price to put down (most of us). For many home buyers, 5% down is still a stretch. Keep in mind that 5% down on $400,000 is substantial @ $20,000.

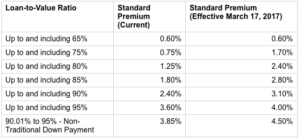

The Loan (amount you need less down payment)-to-Value (Purchase Price) Ratio determines the premium that you will pay on top of the mortgage amount. 5% Down is 95% Owing, 15% down is 85% Owing, etc. The higher the amount owing, the higher the premium.

Lets try an example:

Purchase Price: 400,000

Down Payment: 20,000

Loan to Value Ratio: 380,000/ 400,000 or 95%

Premium Rate @ 95% is 4.00% (see below chart)

Therefore,

$380,000 X 4.00% (.040)= $15,200, is added to your mortgage loan. In this case, the new ‘insured’ mortgage amount would become $395,200.

The bottom line is that much of your downpayment gets eaten up by the cost of the insurance, and the equity that you have on transfer is less than the 5% down payment.

Looking for an upside? You are able to purchase a home with less than 20% down, which allows you to get into the market sooner.

As always, we look forward to any questions that you have!